Know which SBI Savings Accounts Have No Minimum Balance Requirements?

India's largest bank SBI last week clarified that charges for non-maintenance of monthly average balance does not apply to all its bank accounts. In a Twitter post SBI said that corporate salary accounts, small and basic savings bank deposit account and accounts opened under Pradhan Mantri Jan-Dhan Yojna are exempted from maintaining monthly average balance. Out of the 40 crore savings bank accounts that SBI has, 13 crore accounts fall under these exempted category, the state-owned lender said.

Account holders of the following types of accounts are exempt from requiring to maintain an average monthly balance: pic.twitter.com/qNrsGQm8Oi— State Bank of India (@TheOfficialSBI) September 16, 2017

- SBI also said that those who want to avoid paying monthly average balance non-maintenance charges, they can convert their savings account to basic savings bank deposit account without any cost.

- Eligibility criteria to open the Basic Savings Bank Deposit account are same as it is there in case of regular savings bank account. However, the customer cannot have any other savings bank account if he/she has a Basic Savings Bank Deposit Account, SBI said.

- There are also some limitations in this account. Customers of these accounts are allowed to do only four free withdrawals in a month, including ATM withdrawals at own and other bank ATMs and transactions through other modes including RTGS/NEFT/Clearing/Branch cash withdrawal/transfer/internet debits/standing instructions/EMIs debit etc. After the four free ATM withdrawals, customers of Basic Savings Bank Deposit Account will be charged Rs. 50 plus tax for cash withdrawal at an SBI branch, Rs. 20 plus tax at other bank ATMs and Rs. 10 plus tax at SBI ATMs, SBI said.

- Last week, SBI also said that it is reviewing charges for certain categories of accounts for non-maintenance of monthly average balance (MAB) after receiving feedback from customers. In April this year, SBI reintroduced charges on non-maintenance of monthly average balance (MAB) after a gap of five years. "We have received feedback from our customers on the issue and we are reviewing those. The bank will take into account those and make an informed decision," SBI managing director (national banking group) Rajnish Kumar told news agency Press Trust of India.

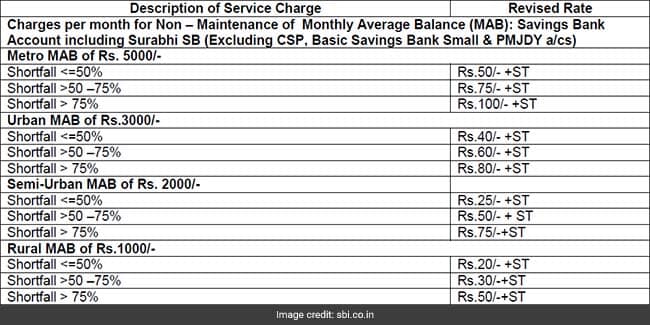

- SBI currently charges a penalty of up to Rs. 100 (plus GST of 18 per cent) per month for not maintaining monthly average balance (MAB) in savings bank accounts. Customers holding SBI savings bank accounts in metro, urban, semi-urban and rural branches need to pay different penalty amounts for non-maintenance of monthly average balance, according to SBI's website.

- SBI has specified penalty for various ranges of shortfall for its savings bank customers depending on the categories of branches - rural, semi-urban, urban and metro. For example, if your SBI savings bank account is in one of the metro city branches, you need to maintain a monthly average balance of Rs. 5,000. Also, if the average balance maintained during a month comes out to be between zero and Rs. 1,500, or a shortfall of more than 75 per cent, a non-maintenance charge of Rs. 100 plus GST of 18 per cent will be levied for the month. In case the average balance remains within Rs. 1,500 and Rs. 2,500, which means a shortfall of less than 75 per cent and more than 50 per cent, a charge of Rs. 75 plus taxes will be levied, SBI has said.

SBI charges :

(SBI charges penalty between Rs. 20 to Rs. 100/month for not maintaining minimum balance)

(SBI charges penalty between Rs. 20 to Rs. 100/month for not maintaining minimum balance)

Meanwhile, for savings accounts with average balance of more than Rs. 2,500, SBI will charge a penalty of Rs. 50, plus taxes.

However, for account holders in urban areas other than metros, semi-urban and rural areas, the MAB requirements are Rs. 3,000, Rs. 2,000 and Rs. 1,000 respectively.

image courtesy : sbi bank

thank you...

No comments:

Post a Comment